The Saskatchewan Crop Insurance Corporation (SCIC) continues to support producers facing losses due to wildlife through the Wildlife Damage Compensation and Prevention Program. If wildlife has damaged your crop, SCIC encourages you to report your loss and register a claim prior to swathing.

Technology Enhances Inspections

In 2024, SCIC launched a pilot program integrating unmanned aerial vehicle (UAV) technology into the wildlife damage claims process. This innovative approach uses UAVs and artificial intelligence (AI) to enhance inspections, reduce manual observation time and provide producers with AI-generated maps illustrating damage and supporting claim calculations.

UAV mapping is integrated into the claims process for certain types of wildlife damage. Inspections take place in standing crops before harvest to assess crop loss and determine whether there is a need for future prevention strategies.

How UAV and AI Technology Work Together

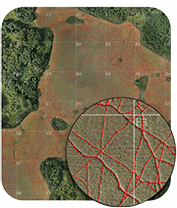

SCIC provides an inspection for the damaged crops identified by the producer’s legal land descriptions. As part of the updated inspection process, UAVs capture between 250 and 350 high-resolution images while flying over the producer’s fields. These images are then stitched together using software to create a detailed, full-field view.

The first image shows the stitched aerial photo of the field before AI analysis. The second image with red trails is the result of AI processing, which identifies wildlife trails and beds while calculating the total crop damage.

Claim Calculations

Using images and AI to measure the area of wildlife trails and beds, SCIC determines the total acres damaged by wildlife. Wildlife damage compensation is available on claims $150 and over. Claims are calculated by establishing the lost yield of the total damaged acres. The approach to assessing the yield depends on whether a producer has a Crop Insurance contract on the specified legal land description.

- Insured Crops: Yields are determined using the Production Declaration submitted by the producer.

- Uninsured Crops: Yields are based on the annual average yield of the insured acres in the area.

As part of this inspection process, SCIC sends field maps to the producer’s email address on file. If your contact information has changed, please update SCIC to ensure maps are received on the wildlife claims. Once harvest is complete and yields are finalized, the wildlife claim is calculated and an initial payment of 75 per cent issued, if eligible. In March, wildlife prices are set and the remaining 25 per cent of the wildlife damage claim is processed.

Looking ahead, SCIC is committed to evaluating emerging approaches, aligning with SCIC’s service goals and ensuring UAV and AI adoption is guided by evidence, impact and customer value. For more information, visit scic.ca, contact your local SCIC office or call 1 888-935-0000.

Submit Your Claim

To ensure accurate assessments and timely compensation, producers are encouraged to report wildlife damage as soon as it is observed and before harvesting the affected crop.

All Saskatchewan producers who report farm income and expenses are eligible for this program – no prior enrolment or SCIC coverage is required. Eligible producers may receive 100 per cent compensation for damage to commercial agricultural products, as outlined in the Wildlife Damage and Livestock Predation Regulations.

To register a wildlife damage claim, producers can contact their local SCIC office or call 1 888-935-0000.

Why Livestock Price Insurance Still Makes Sense This Fall – Even with Strong Cattle Prices

In 2025, cattle prices reached record highs. This is good news for Saskatchewan livestock producers. Yet high market prices can come with their own risk. Currently, the market is strong, but the market is also uncertain and unpredictable. Market prices have risen because of tight cattle supplies across North America. Both Canadian and U.S. herds are at their lowest levels in decades.

Saskatchewan feeder steers are well above their five-year average market price. Despite these supply constraints, beef demand remains strong in Canada, including Saskatchewan, where consumers continue to prioritize beef in their diets and export markets remain robust. Even with strong market fundamentals, there are still plenty of unknowns ahead.

What is adding to livestock market risk?

- Trade tensions: the threat of tariffs creates uncertainty, which makes for fragile and volatile market conditions.

- Small herds: low supply with strong beef demand supports high prices, but it also means any disruptions, like disease or export issues, could hit hard and have ripple effects.

- Weather: dry conditions in parts of Saskatchewan drive up feed costs and affect herd decisions.

Why insure when prices are high?

Livestock Price Insurance (LPI) lets you protect today’s high prices as a floor. If the market holds, you can still sell at strong prices. But if prices drop, LPI coverage kicks in. The higher the value of your cattle, the higher the loss if prices were to fall. LPI is a proactive risk management program you can leverage to help protect the value of your livestock.

Flexible coverage that works for you

LPI is a floor price, protecting the downturn in the market with full upside potential. You are never required to sell during the life span of your LPI policy. You remain in control of all your marketing decisions. You choose the coverage level and policy length that meet the needs of your operation. Coverage levels are determined using real data from the Chicago Mercantile Exchange futures. LPI’s forward price methodology is certified as actuarially sound and is not a prediction.

You raise your livestock. LPI protects their worth.

When livestock prices are high, insurance might not be top of mind, but do not overlook the value. LPI gives you peace of mind in an unpredictable market – helping you plan and protect your bottom line.

Want to learn more?

Call SCIC toll-free at 1-888-935-0000 or visit the Livestock Price Insurance website.