Investor Relations

Investors from across Canada and around the world are able to invest in Saskatchewan through bonds issued by the provincial government. The government uses the funds raised as part of its financing activities.

To help ensure that potential investors are well-informed about the current economic situation and forecasts in Saskatchewan, the following documents are made available:

1. Borrowing Strategy and Issuance Documents

Borrowing Strategy

Saskatchewan’s public borrowing program has primarily been concentrated in the Canadian domestic market and is expected to remain so going forward. In recent years, however, the Province has expanded its issuance in international markets, with an objective of maintaining approximately 25% of total outstanding debt from international issuance.

Domestic borrowing is focused on 10- and 30-year terms. The Province’s longer maturity profile reflects the fact that the debt is primarily supporting investment in longer term capital assets by both Executive Government and Crown Corporations. The average term of debt has decreased over the last five years due to increased international issuances with shorter maturities.

Depending on borrowing requirements, the Province would look to issue in the USD and/or EUR market every 12-18 months to maintain a consistent presence. Issuance in other currencies will still be contemplated, but would likely be smaller deal sizes, issued opportunistically, and likely with longer tenors.

The Province’s standard practice is to fully hedge internationally issued bonds into fixed-rate Canadian dollar liabilities through the use of derivative instruments.

The Province maintains a target cash balance of approximately $1.5 billion. Additional sources of liquidity include authorization to issue short-term notes of up to $4.0 billion, as well as access to a $3.3 billion government bond fund, which could be liquidated if primary debt markets become challenging.

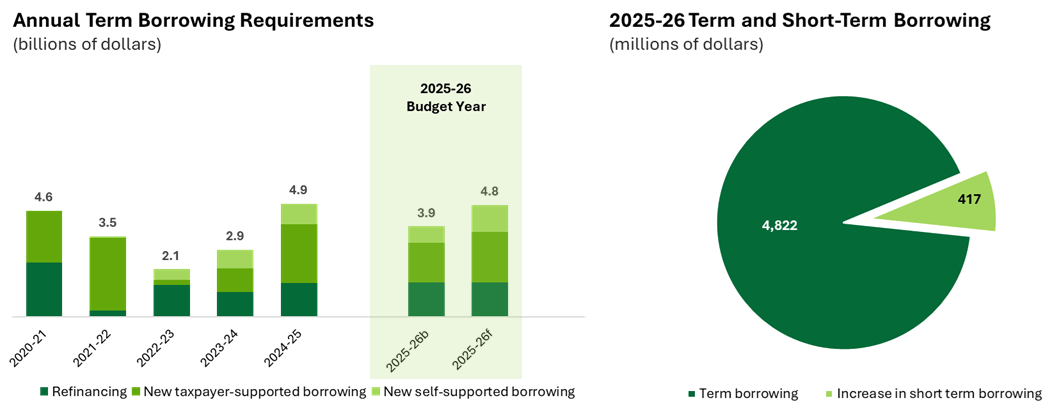

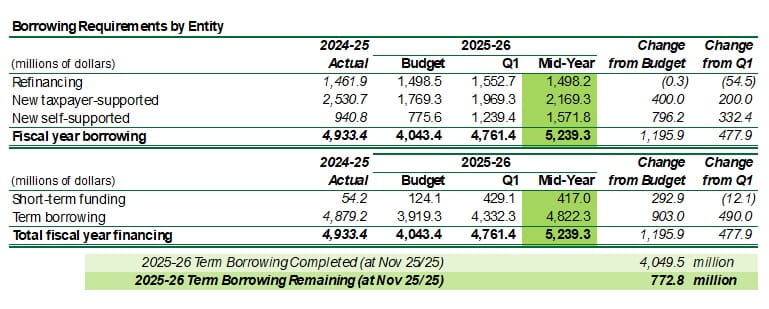

Borrowing Plan

Euro Medium Term Notes Programme (EMTN)

Press release - €1.00 Billion Benchmark Issuance (September 24, 2035)

Press release - €1.25 Billion Benchmark Issuance (May 8, 2034)

Saskatchewan Offering Circular

Debt Issuance Documents

Term Debt Outstanding as of March 31, 2025

Regulatory Filings and Listings

Provided for your convenience are the following links to the Province of Saskatchewan’s information made available on external sites:

2. Investor Presentations and Resources

Investor Fact Sheet

The Investor Fact Sheet lists key points of Saskatchewan's fiscal overview, debt information, borrowing requirements and economic forecasts.

- Mid-Year 2025-26 Investor Fact Sheet

- Q1 2025-26 Investor Fact Sheet

- Budget 2025-26 Investor Fact Sheet

Investor Presentation

The Investor Relations Presentation comprehensively overview Saskatchewan’s economy, economic forecasts, and environmental sustainability.

Saskatchewan’s economy and statistics

Saskatchewan's Dashboard opens a window into what's going on in the province. Key economic indicators such as capital investment, gross domestic product, consumer price index, business industry, trade, employment and labour market statistics, and housing and construction data can be accessed.

The Saskatchewan Bureau of Statistics is the province's statistical agency.

The Bureau is part of Canada's national statistical system. In conjunction with our Federal, Provincial and Territorial partners, the Bureau participates in the co-ordination of statistical activity within the country and represents Saskatchewan's interests within the system.

Learn more about Saskatchewan's competitive advantages and investment opportunities in key sectors of our economy.

Government of Saskatchewan News

Find articles, photos and videos for recent news and media events. Search for past press releases by accessing provincial news media.

4. Environmental, Social and Governance

Saskatchewan has some of the highest-quality and sustainably produced food, fuel and fertilizer that a growing world needs. Visit Sustainable Saskatchewan to learn more about the province's sustainable resources, environmental stewardship, community support and clean energy.

5. Credit Ratings

Investors are especially interested in the province's long-term and short-term credit ratings, as determined by the major credit rating agencies: