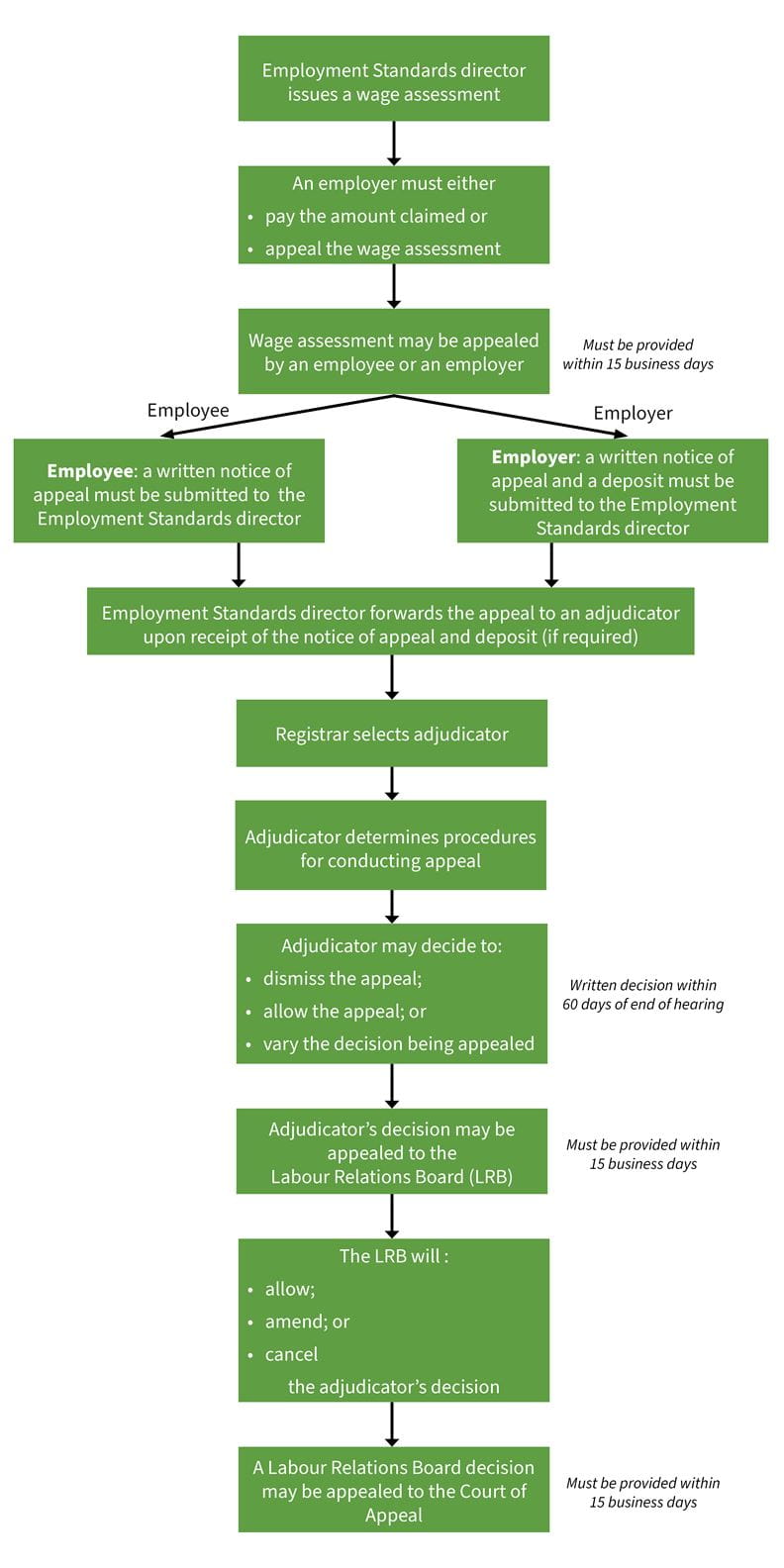

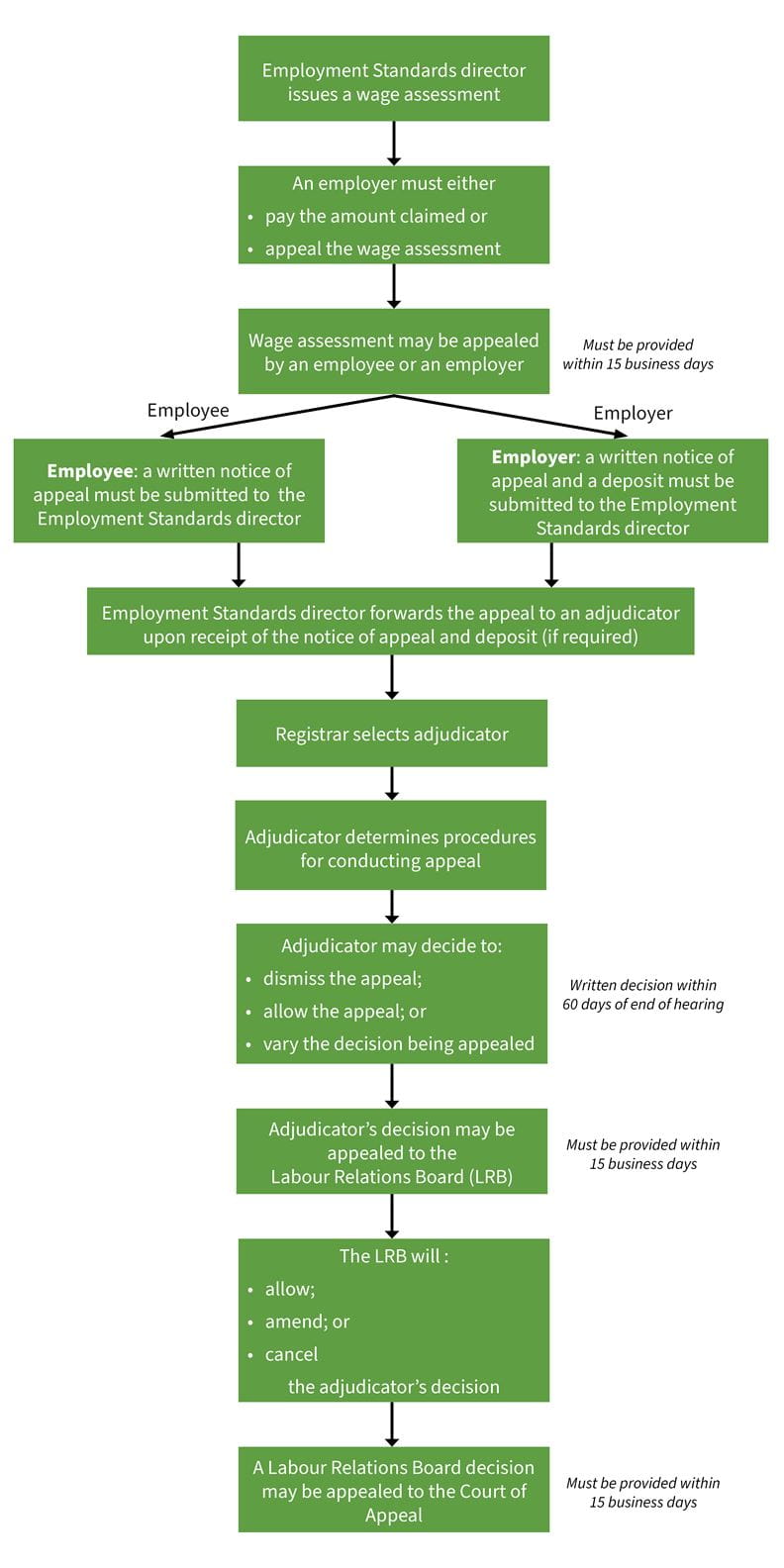

Appealing the Director's Decision to an Adjudicator

Once Employment Standards is provided the notice of appeal and the deposit (if applicable), the registrar of the Labour Relations Board (the Board) is informed that an appeal has been filed. The registrar is responsible for:

- selecting an adjudicator; and

- consulting with the adjudicator and the parties involved to set:

- a time;

- a date; and

- a place for the hearing.

Once notified that an adjudicator has been selected, the director will forward copies of the wage assessment and the written notice of the appeal to the adjudicator.

If Employment Standards is served an appeal and appeal deposit (even the correct amount) outside of the 15 business day time limit in the legislation, the adjudicator may decide that they lack the jurisdiction to hear the appeal. In these cases, if the adjudicator decides that the wage assessment was not appealed correctly by law, the wage assessment remains in effect, and the wages may be recovered.

Adjudicators

Adjudicators are independent of Employment Standards and are responsible for hearing all evidence and arguments from each party. They determine how a hearing will be conducted. They are not bound by the normal rules of evidence, meaning they may accept any evidence they consider appropriate.

Hearings

Hearings are a new consideration of the matter by the adjudicator. The appellant must present their case and information to the adjudicator as if it had not been heard before by the investigating officer. Appellants may represent themselves or have a lawyer or another person act on their behalf at a hearing. The parties to the appeal are not required to be physically present at a hearing and can attend by phone or video if allowed by the adjudicator. Appellants may be required to present additional relevant documents, provide testimony or testify during a hearing.

Adjudicator's Decision

Following the hearing, the adjudicator can decide to accept, dismiss the appeal or vary the amount of the wage assessment.

The adjudicator must provide written reasons for the decision to the Board, Employment Standards, and any employees, the employer and liable corporate director within 60 days of the end of the hearing. If a decision is not received after 60 days, Employment Standards may contact the adjudicator by letter to request their decision. If the 60-day timeline is passed and a decision has not been made, the Board can compel the adjudicator to produce a decision. If for any reason the adjudicator does not provide a decision, the Board can appoint a new adjudicator.

Appealing the Adjudicator's Decision to the Labour Relations Board

If the employee, employer or liable corporate director does not agree with the adjudicator's decision, they may appeal on a question of law with the Board within 15 business days of receiving the decision. A question of law is about the correct legal test. Appeals generally can not be reheard on the facts.

If Employment Standards does not agree with the adjudicator's decision, they can provide a notice of appeal with the Board within 30 business days of the date the decision was served. An appeal to the Board by Employment Standards can be based on a question of law or a question of mixed law and fact. Mixed law and fact means whether the facts meet the legal tests.

The appellant is required to provide copies of the notice of appeal to the same parties involved in the appeal to the adjudicator. The appellant is also responsible for providing case documents (known as a record of appeal) which consists of:

- the wage assessment or notice of hearing;

- the notice of appeal;

- any documents filed with the adjudicator during the hearing;

- the written decision of the adjudicator;

- the notice of appeal to the Board; and

- any other documents required by the Board.

Once the Board reviews the notice of appeal and record of appeal, it has the authority to affirm, amend or cancel the adjudicator's decision. They can also send the decision back to the adjudicator for amendment. Once an appeal is submitted to the Board, the adjudicator's decision is still in effect, unless the Board orders otherwise.

Appealing the Board's Decision to the Court of Appeal

A request for leave to appeal of the Board's decision on a question of law can be made to the Court of Appeal by the employee, employer, corporate director or director of Employment Standards within 15 business days of receiving the Board's decision. The rules of the Court of Appeal apply.