Released on July 22, 2022

Today, the provincial government brings into force the Taxpayers’ Fairness (CPR) Act, which was passed in the spring session of the Legislature with unanimous support.

This Act supplements two other recently passed pieces of legislation: the Constitution Amendment (Saskatchewan Act), 2022, passed by Saskatchewan's Legislative Assembly, the House of Commons, and the Senate; and provisions in the federal Budget Implementation Act, 2000, passed by Parliament in late June.

“We always want to ensure that the people of Saskatchewan receive their fair share from companies doing business in our province,” Minister of Justice and Attorney General Bronwyn Eyre said. “The argument that any company is exempt from taxation is unfair to taxpayers and other businesses that operate here.”

CPR currently has a claim against Saskatchewan that is being litigated in the Saskatchewan Court of Queen's Bench. It is anticipated that the three pieces of legislation noted above will be considered by the Court in the action.

In September, 2021, the Federal Court completely dismissed CPR's claim against the federal government, and later ordered that it pay costs of over $1.6 million.

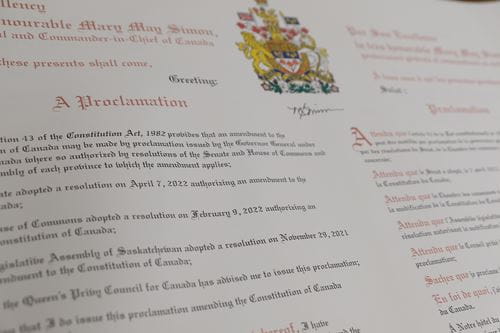

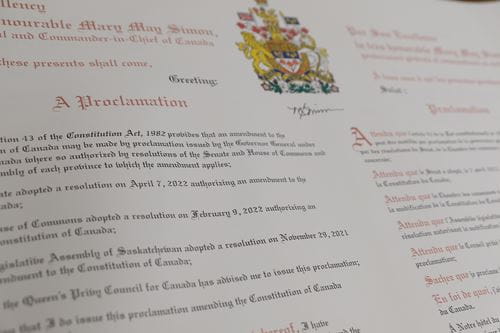

On November 29, 2021, the Legislative Assembly of Saskatchewan unanimously passed a resolution for the repeal of section 24 of The Saskatchewan Act, 1905, pursuant to section 43 of the Constitution Act, 1982. This amendment is retroactive to August 1966. The amendment was proclaimed by the Governor General on May 6, 2022.

CPR has also sued the federal government, Alberta and Manitoba, raising similar claims that it is exempt from taxes. The claims against Alberta and Manitoba have not yet gone to trial.

-30-

For more information, contact:

Justice and Attorney General

Regina

Phone: 306-787-8959

Email: cpjumedia@gov.sk.ca