Released on November 1, 2019

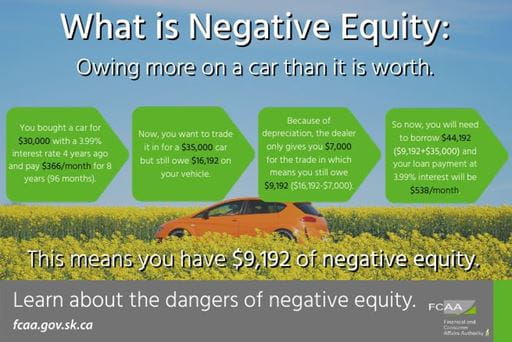

The Financial and Consumer Affairs Authority (FCAA) would like to educate consumers on vehicle negative equity. Vehicle negative equity occurs when a consumer owes more for a vehicle than what it is worth. Vehicle negative equity often takes place because of the lure of extended term loans (ETLs).

Consumers can purchase the vehicle of their dreams, with no money down, for a monthly, bi-weekly or weekly payment that appears to be affordable. Traditionally, four to five-year vehicle loans were the norm. Today, it’s common for consumers to finance their vehicle over seven to eight years which is a significant amount of time for a product that begins depreciating the second you drive it off the lot.

“While getting an extended term loan to help finance a vehicle over a period of seven or eight years may seem like a good idea, having these loans can result in negative equity when a consumer wants to trade in their vehicle prior to paying the loan off,” FCAA Deputy Director of Consumer Protection Denny Huyghebaert said. “We have seen situations where a consumer has traded in their old vehicle for a $70,000 new truck, but due to the debt still owing on their previous vehicle, the consumer actually had to pay $110,000 to acquire the new truck.”

How to Avoid Negative Equity:

- Consider a shorter term loan to minimize the possibility of being in a negative equity position.

- Make a sizeable cash down payment when purchasing the vehicle.

- Pay off existing vehicle loans to avoid rolling negative equity forward into a new vehicle purchase.

- Don’t just focus on the monthly payment when purchasing a vehicle, consider the total price of the vehicle and the length of the loan.

- Have a vehicle budget in mind and stick to it.

Contact Consumer Protection Division

Consumers with questions can call toll free at 1-877-880-5550 or email at consumerprotection@gov.sk.ca.

For more information about negative equity visit https://fcaa.gov.sk.ca/consumers-investors-pension-plan-members/consumers/consumers-of-goods-and-services/purchasing-and-repairing-a-vehicle/negative-equity.

-30-

For more information, contact:

Shannon McMillan

Financial and Consumer Affairs Authority

Regina

Phone: 306-798-4160

Email: shannon.mcmillan@gov.sk.ca